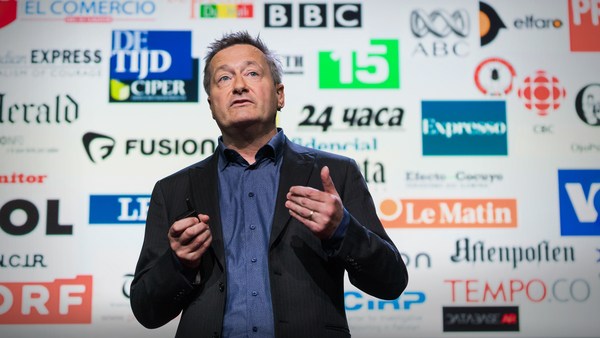

[On April 3, 2016 we saw the largest data leak in history.] [The Panama Papers exposed rich and powerful people] [hiding vast amounts of money in offshore accounts.] [What does this mean?] [We called Robert Palmer of Global Witness to explain.]

This week, there have been a whole slew and deluge of stories coming out from the leak of 11 million documents from a Panamanian-based law firm called Mossack Fonseca. The release of these papers from Panama lifts the veil on a tiny piece of the secretive offshore world. We get an insight into how clients and banks and lawyers go to companies like Mossack Fonseca and say, "OK, we want an anonymous company, can you give us one?" So you actually get to see the emails, you get to see the exchanges of messages, you get to see the mechanics of how this works, how this operates.

Now, this has already started to have pretty immediate repercussions. The Prime Minister of Iceland has resigned. We've also had news that an ally of the brutal Syrian dictator Bashar Al-Assad has also got offshore companies. There's been allegations of a $2 billion money trail that leads back to President Vladimir Putin of Russia via his close childhood friend, who happens to be a top cellist. And there will be a lot of rich individuals out there and others who will be nervous about the next set of stories and the next set of leaked documents.

Now, this sounds like the plot of a spy thriller or a John Grisham novel. It seems very distant from you, me, ordinary people. Why should we care about this? But the truth is that if rich and powerful individuals are able to keep their money offshore and not pay the taxes that they should, it means that there is less money for vital public services like healthcare, education, roads. And that affects all of us.

Now, for my organization Global Witness, this exposé has been phenomenal. We have the world's media and political leaders talking about how individuals can use offshore secrecy to hide and disguise their assets -- something we have been talking about and exposing for a decade.

Now, I think a lot of people find this entire world baffling and confusing, and hard to understand how this sort of offshore world works. I like to think of it a bit like a Russian doll. So you can have one company stacked inside another company, stacked inside another company, making it almost impossible to really understand who is behind these structures. It can be very difficult for law enforcement or tax authorities, journalists, civil society to really understand what's going on.

I also think it's interesting that there's been less coverage of this issue in the United States. And that's perhaps because some prominent US people just haven't figured in this exposé, in this scandal. Now, that's not because there are no rich Americans who are stashing their assets offshore. It's just because of the way in which offshore works, Mossack Fonseca has fewer American clients. I think if we saw leaks from the Cayman Islands or even from Delaware or Wyoming or Nevada, you would see many more cases and examples linking back to Americans.

In fact, in a number of US states you need less information, you need to provide less information to get a company than you do to get a library card. That sort of secrecy in America has allowed employees of school districts to rip off schoolchildren. It has allowed scammers to rip off vulnerable investors. This is the sort of behavior that affects all of us.

Now, at Global Witness, we wanted to see what this actually looked like in practice. How does this actually work? So what we did is we sent in an undercover investigator to 13 Manhattan law firms. Our investigator posed as an African minister who wanted to move suspect funds into the United States to buy a house, a yacht, a jet. Now, what was truly shocking was that all but one of those lawyers provided our investigator with suggestions on how to move those suspect funds. These were all preliminary meetings, and none of the lawyers took us on as a client and of course no money moved hands, but it really shows the problem with the system.

It's also important to not just think about this as individual cases. This is not just about an individual lawyer who's spoken to our undercover investigator and provided suggestions. It's not just about a particular senior politician who's been caught up in a scandal. This is about how a system works, that entrenches corruption, tax evasion, poverty and instability. And in order to tackle this, we need to change the game. We need to change the rules of the game to make this sort of behavior harder.

This may seem like doom and gloom, like there's nothing we can do about it, like nothing has ever changed, like there will always be rich and powerful individuals. But as a natural optimist, I do see that we are starting to get some change.

Over the last couple of years, we've seen a real push towards greater transparency when it comes to company ownership. This issue was put on the political agenda by the UK Prime Minister David Cameron at a big G8 Summit that was held in Northern Ireland in 2013. And since then, the European Union is going to be creating central registers at a national level of who really owns and controls companies across Europe.

One of the things that is sad is that, actually, the US is lagging behind. There's bipartisan legislation that had been introduced in the House and the Senate, but it isn't making as much progress as we'd like to see. So we'd really want to see the Panama leaks, this huge peek into the offshore world, be used as a way of opening up in the US and around the world.

For us at Global Witness, this is a moment for change. We need ordinary people to get angry at the way in which people can hide their identity behind secret companies. We need business leaders to stand up and say, "Secrecy like this is not good for business." We need political leaders to recognize the problem, and to commit to changing the law to open up this sort of secrecy.

Together, we can end the secrecy that is currently allowing tax evasion, corruption, money laundering to flourish.